Annus Horribilis for a Volatile 2016

It has been a horrible year for the rand as Fed tightening, commodity prices and China’s slowdown combined with a dire domestic situation to weaken the currency. And while 2016 will see some improvement in the macro picture, South Africa’s economy remains structurally flawed, pointing towards more rand weakness.

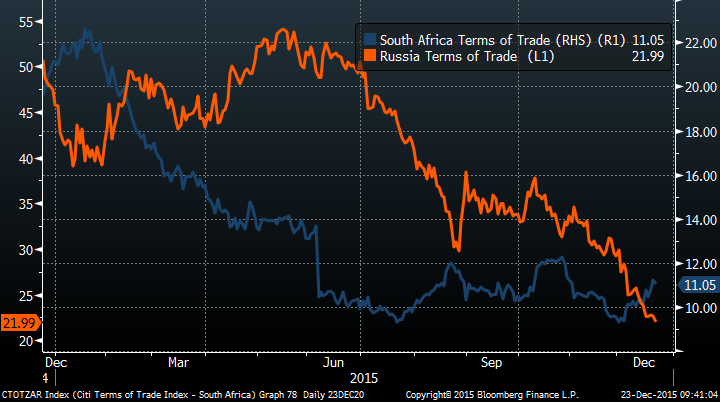

The macro concerns have not gone away, but the most acute period of pain is probably over. The U.S. has made the initial leap in raising interest rates and given a more certain outlook for the path of rate hikes next year. The genuine worry about China’s growth prospects is priced into the market. While plunging energy prices mean South Africa’s terms of trade have remained relatively stable over the past 5 months compared with oil exporters such as Russia.

That’s the good news. The bad news is that the economy’s structural flaws are here to stay. Unemployment remains stubbornly above 25 percent. Political issues, including a power struggle at the top of the ANC, are weighing on international credibility. The sacking of Finance Minister Nhlanhla Nene on Dec. 9 was a big hit to the country’s credibility which the appointment of Pravin Gordhan a few days later has not amended.

Growth projections continue to be downgraded by economists; 2016 consensus GDP forecast is now for 1.4 percent growth compared with 2.4 percent in July. After November’s PMI data fell to the lowest level in 6 years, there is a risk that even these reduced figures could be over-optimistic.

The current-account deficit of 4.2 percent of GDP remains a major risk for the currency, though it has narrowed recently, especially in a world where U.S. rates are going up. This keeps upward pressure on South African yields, which only further constrains the growth outlook.

The rand has roughly halved in value against its trade-weighted index over the past 4-and-a-half years. It has fallen much more against both the Chinese yuan, and China is South Africa’s key trading partner, and against the dollar, which is the currency denomination for much of the country’s borrowing at both sovereign and corporate level. All this currency weakness helps ease those domestic concerns but data is not yet indicating that the rand is overly cheap.

So what’s the ultimate conclusion for the rand? Volatility, perhaps. It’s unlikely that we’ve reached the nadir for the rand, but a more conducive macro environment may lead to occasional powerful rallies as investors finally start returning to emerging markets globally. After over four years of trending weakness for the rand, 2016 may be more of a trader’s market.

Note: Mark Cudmore is an EM strategist who writes for Bloomberg. The observations he makes are his own and are not intended as investment advice.